Open Bank Account Online

BANKING WHEN YOU NEED IT

Open a bank account online

Community Free Checking and more! Open a personal checking account, savings account, or CD with Community First Bank.

Choose the best checking account for you:

Community Direct Interest Checking

Earn interest with the convenience of direct deposit or any automatic payment.

Choose the best savings account for you:

Personal Money Market

Santa’s Helper

Santa’s Helper

Choose the best CD term for you:

What You'll Need:

Social Security Number

Mailing Address (not PO Box)

Driver’s License

Current account and routing number if you choose to make your opening deposit electronically

Need help?

Minimum opening deposit is only $50. Ask us for details. Bank rules and regulations apply. Other fees such as non-sufficient funds, overdraft, sustained overdraft fees, etc. may apply. See fee schedule for details. Free gift may be reported on a 1099-INT or 1099-MISC. Free gift provided at the time of account opening. We reserve the right to substitute a gift of similar value. Offer good on personal accounts only. Ask us about our outstanding options for your business or organization.

For savings, see deposit account agreement and fee schedule for additional details.

Must be 18 or over, a US citizen or resident alien with a valid taxpayer identification number (TIN), and be located in surrounding counties to Community First Bank’s branch locations to apply online. Contact Community First Bank for details.

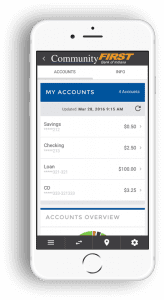

Community First Bank of Indiana does not charge a fee for Mobile Banking. Third party message and data rates may apply. Check with your wireless carrier for details. Mobile Deposit User Agreement and Disclosures required prior to set up.

To apply online with Community First Bank: For checking and savings accounts, applicants must be 18 or older, a U.S. citizen or resident alien with a valid taxpayer identification number (TIN), and located in counties surrounding Community First Bank branch locations. For Certificates of Deposit, applicants must meet the same age and citizenship requirements and be located anywhere in Indiana. Contact Community First Bank for details.

Minimum opening deposit is only $50. Ask us for details. Bank rules and regulations apply. Other fees such as non-sufficient funds, overdraft, sustained overdraft fees, etc. may apply. See fee schedule for details. Free gift may be reported on a 1099-INT or 1099-MISC. Free gift provided at the time of account opening. We reserve the right to substitute a gift of similar value. Offer good on personal accounts only. Ask us about our outstanding options for your business or organization.

For savings, see deposit account agreement and fee schedule for additional details.

Community First Bank of Indiana does not charge a fee for Mobile Banking. Third party message and data rates may apply. Check with your wireless carrier for details. Mobile Deposit User Agreement and Disclosures required prior to set up.