Contact Community First Bank of Indiana and let your banker know which accounts you would like to be a part of the program.

Make this card your primary card. Use it for all of your everyday purchases and watch your savings grow automatically.

Tip: Use the debit card from your enrolled checking account for online and recurring payments to maximize savings.

We’ll round up your purchases to the nearest whole dollar and transfer the change from your checking account to your designated checking or savings account each day.

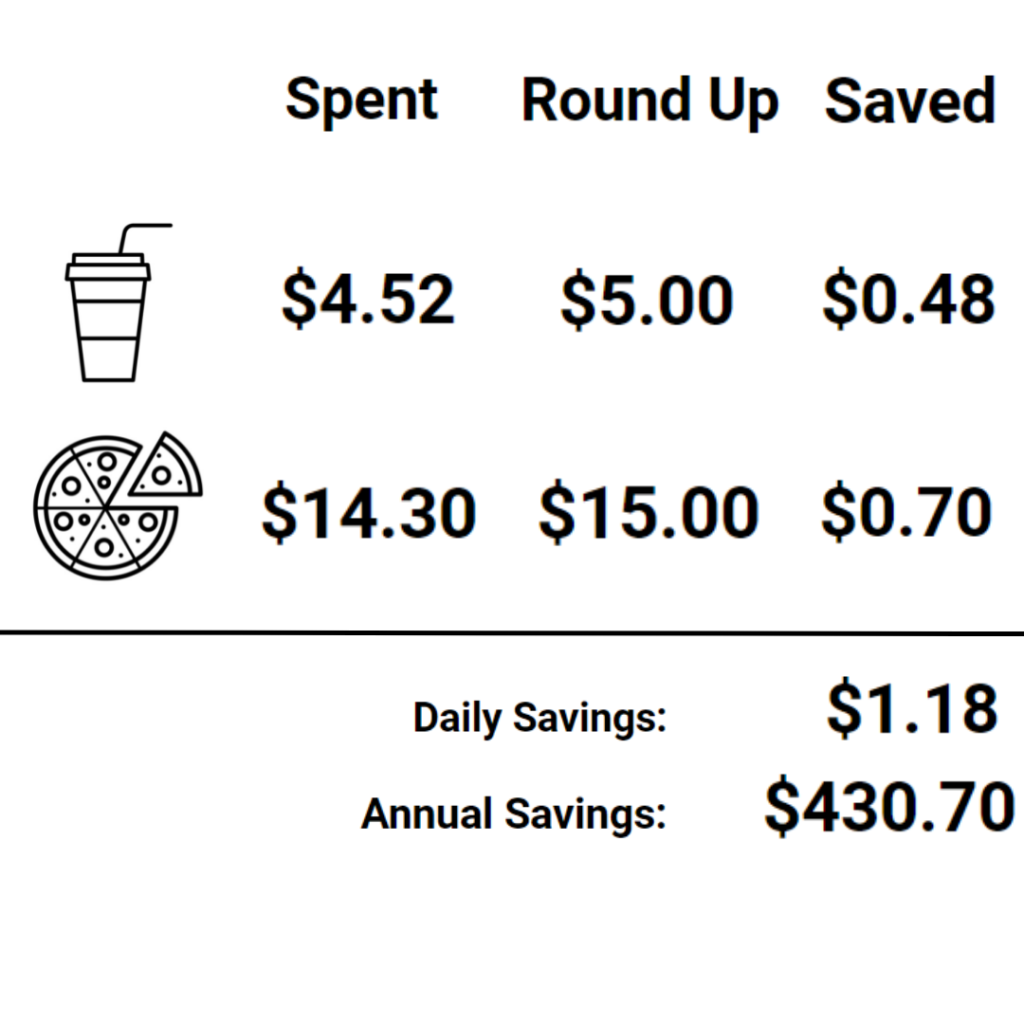

This chart is for illustrative purposes only. Actual change saved could accrue faster or slower, depending on debit card usage.

Yes, we will transfer the change from purchases from funds in your enrolled checking account to your designated checking or savings account.

No, the accounts have to be titled the same in order for the Round Up Savings to be set up.

The account will round up to the nearest $1. For example, if you spend $6.30, at the end of the business day, the account will transfer $0.70 to the qualified account the customer selected.

Contact Community First Bank of Indiana and let your banker know which accounts you would like to be a part of the program.

No, this is an unlimited transfer since it is your money.

Yes, it will show as RUS Transfer Debit for the transfer out of your account and it will show as RUS Transfer Credit for when it goes into your receiving account.

No, it will be one transaction all together. For example, if you spend $9.50, $3.50 and $5.50 in one day, the transfer at the end of the day will be $1.50 into your qualified account.

The transfer will not happen if the account is in an NSF status.

At this time, we are not participating in the Matching side of Round Up Savings.

Contact Community First Bank and let us know you would like to cancel your Round Up Savings Transfers.

No, there is no signature required for this program.

Account level – all debit cards associated with the eligible account will automatically be enrolled.

The transfer will happen when the transaction hard posts to the account. Not at the time of transaction.

No, the transactions come from debit card purchases only. Automatic Transactions (ACH) are not included in Round Up Savings.

Terms and Conditions: The Round Up Savings program (the “Program”) is designed to help build savings by rounding your debit card purchase up to the nearest next whole dollar and transferring that amount automatically (the “transfer”) to another eligible account. Eligibility to participate is contingent on approval of debit card application. Not all customers will qualify to use, or continue using, debit card services. To enroll/unenroll, simply notify Community First Bank of Indiana (the “Bank”) after reviewing these terms and conditions. Enrollment changes may take up to 5 business days to complete before transfers begin/end.

Only personal consumer checking and saving accounts are eligible to participate. Enrolled checking accounts must be singularly linked to an eligible account. All owners of the enrolled checking account must be owners of the linked account. When a customer enrolls a debit card into the Program, all debit cards linked to that checking account become enrolled and all purchases made from any card linked to that checking account will experience the rounding and transfers. Only one participating account may be linked to an enrolled checking account. Likewise, only one enrolled checking account may be linked to a participating account receiving the transfer. Debit card transactions processed outside of the Bank’s control determine the eligibility of transactions for the Program. Only debit card transactions processed as Point-of-Sale will be eligible. Some transactions that would be expected to be eligible for the Program may be processed as an other-than-eligible transaction by processors or merchants. In these cases, the Bank is unable to recognize these as eligible transactions. Known transactions that are ineligible include: recurring debits; ATM transactions; international transactions and associated fees (known as cross border fees); credit transactions. Eligible transactions are subject to change without notice to the customer, prior to or otherwise.

The difference between your debit card transaction settled amount, or posted amount, and that amount rounded to the next whole dollar (the “difference”) is the amount eligible to be transferred. Differences are aggregated at the end of each business day, and a single transfer will be made from your enrolled checking account to your linked account for that amount. In the event that the checking account lacks sufficient funds for any transaction, the difference will not be transferred for that business day. If a transaction is corrected by a merchant, or otherwise altered from the original purchase, the transfer amount will not be altered by the bank. That is, once a transfer is made, regardless of subsequent related transactions to the checking account, the transfer to savings will not be modified, altered, reversed or revoked unless done so to correct a bank error.

Occasionally, Community First Bank of Indiana may offer a promotional period whereby your transfers may be matched. In such case, the Bank will deposit an amount equivalent to the difference, either daily or in a Bank-defined period, into the linked account (the “match”). This match may be subject to IRS 1099 reporting. The maximum total match amount will not exceed $599.99 (five-hundred and ninety-nine dollars and ninety-nine cents) per calendar- year, per account. This promotional period may begin or end without prior notice to customers and subsequent funds are subject to all other account agreements once in the possession of the customer. The Bank may make adjustments to deposits or transfers to correct bank errors without prior notice to the customer.

Previously received terms and conditions, account agreement, and regulatory disclosures remain in effect and are supplemented by this agreement. No part of this agreement is intended to negate or supersede provisions of previously received disclosures. The Bank reserves the right to modify or cancel the Program at any time without prior notice to the customer.

Bank NMLS: 614034

Routing Number : 074914407

The following site is independent from Community First Bank of Indiana. The bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. While the bank does not control this site, it is an approved vendor of the bank to securely input your information.

The following site is independent from Community First Bank of Indiana. While the bank does not control this site, it is an approved vendor of the bank to securely input your information.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. While the bank does not control this site, it is an approved vendor of the bank to securely input your information.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. While the bank does not control this site, it is an approved vendor of the bank.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

You are going to a 3rd party site that

Community First Bank of Indiana has contracted to provide financial literacy tools.

While the bank does not control the site, this is an approved vendor of the bank.

You are going to a 3rd party site that

Community First Bank of Indiana has contracted to securely input your application.

While the bank does not control the site, this is an approved vendor of the bank.

You are going to a 3rd party site that

Community First Bank of Indiana has contracted to securely input your application.

While the bank does not control the site, this is an approved vendor of the bank.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.

The following site is independent from Community First Bank of Indiana. The

bank does not control the linked site.